Merchant Cash Advances (MCA’s)

Merchant Cash Advances (MCA’s) are loan alternatives best for businesses that need access to capital immediately to cover cash flow gaps or short-term expenses.

Applying is free and won’t affect your personal credit score.

Apply online today

Complete our online application in less than 5 minutes and enjoy fast processing, no paperwork, and quick approval of your MCA.

Same day funding

Get funded the same day you apply for your MCA. Receive your cash in as little as 24 hours. Our average funding time is 1-3 days.

Bad credit accepted

Bad credit does not prevent you from getting an MCA because the approval process focuses on the strength of your credit card sales.

No credit check

No credit check is conducted when you apply for an MCA. Only a soft credit pull is carried instead of a hard one to ensure your credit won’t be affected.

How does our merchant cash advance work?

When you get a merchant cash advance from MCashAdvance, we provide you with an upfront lump sum of working capital and in exchange, you repay the lump sum, plus a fee from a portion of your business’s future credit card sales.

Approval is based on the strength of your business’s credit card sales not your credit score or how much collateral you can provide.

There are no interest rate payments. Instead, you pay a flat fee called a factor rate, which ranges from 1.1 to 1.5. You repay the advance amount, plus the flat fee, from a percentage of your credit card receipts. This fixed percentage, known as the holdback percentage, ranges from 10% to 25%.

| MCA Feature | MCA Details |

|---|---|

| MCA Amounts: | $5,000 – $900,000 |

| Factor Rate: | 1.1 – 1.5 |

| Holdback Rate | 10 – 25% |

| Repay In: | 3 – 18 months |

| Funding Time: | 1 – 3 days |

Who Should Apply?

Businesses with steady credit sales should consider merchant cash advances when traditional loans are not an option.

Merchant cash advances are mainly for businesses that can’t get traditional loans but have regular credit card sales. This makes getting MCA funding easy.

Even if a business is new, lacks physical collateral, or has less-than-perfect credit, it still has a very high chance of approval for an MCA. This is because approval is based on credit card sales strength, not credit score.

Retail stores, restaurants, hotels, salons, and other businesses that process credit card transactions benefit from using merchant cash advances. It helps them quickly get working capital to deal with seasonal revenue dips and cash flow shortages.

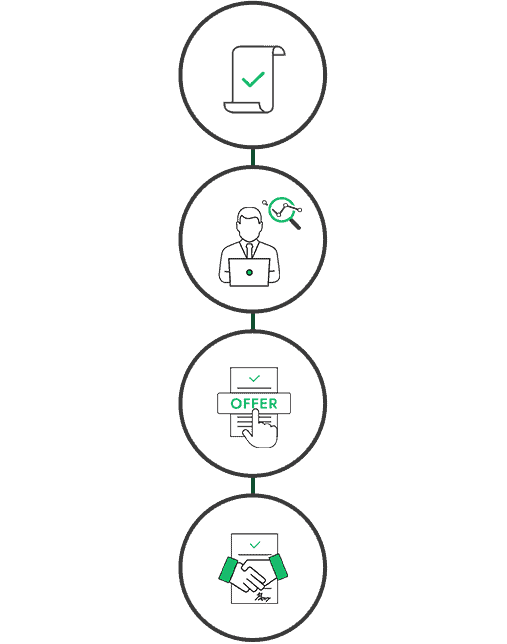

How to get a merchant cash advance

Apply entirely online to get a merchant cash advance from MCashAdvance by following these simple steps:

Step 1. Apply

Online

Fill out our online application form. You only need to provide basic information about your business and its finances.

Step 2. Submit Documentation

Submit the last 3 months of your business bank statements. Or, your credit card processing statements.

Step 3. Let Us Review

Our underwriters will review your MCA application. If everything checks out, they’ll send you an offer.

Step 4. Receive Your MCA

Accept the offer, sign the contract and the up-front lump sum payment will be deposited into your bank account.

To learn about the application process with different merchant cash advance providers, read our “how to apply for an MCA” guide.

Merchant Cash Advance Requirements

Merchant cash advances have far fewer requirements than traditional bank loans and are much easier to qualify for.

The application requirements for a merchant cash advance from MCashAdvance are:

- Monthly credit card sales of at least $7500

- Three months of bank statements or 3 months of merchant processor statements

- Minimum credit score of 550 FICO

- Minimum of 6 months in business

- Must be at least 18 years old

- Must be a US citizen or resident

To find out what other MCA companies may ask for, read qualification requirements for an MCA.

Recent businesses that received merchant cash advances

What are MCA loans?

MCA loans describe merchant cash advances, which provide businesses with upfront cash in exchange for a portion of future credit card sales.

An MCA should not be considered a traditional business loan. The merchant cash advance company is not loaning you money. They don’t charge interest or ask for collateral like a business loan. You won’t pay back a fixed amount plus interest over time like a traditional loan.

Instead, you are being offered an upfront payment and are selling a portion of your future credit and debit sales to pay back the advanced amount.

Repayments fluctuate based on your daily credit card sales. When credit and debit card sales are high, you pay back more of the advance on that day. If sales are on the lower side, you repay less of the advance on that day.

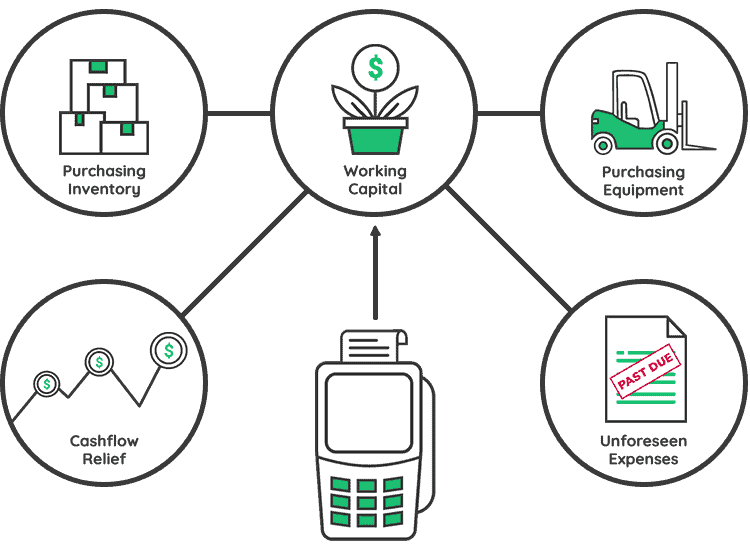

What can a merchant cash advance be used for?

There are no restrictions on what you can use an MCA for in your business. Most business owners use the MCA they receive to help with short-term expenses and purchases.

The 5 most common uses are:

- Supporting cash flow

- Working capital

- Cover unforeseen expenses

- Purchase Inventory

- Equipment Purchases

For a more detailed list of what you can use MCAs for in business, read uses of MCAs

Benefits and Drawbacks

Benefits of a Merchant Cash Advance

The biggest benefit of a merchant cash advance is fast funding that is easy to qualify for. With same-day funding, no collateral, and minimal paperwork, it is one of the fastest and easiest ways to get working capital for your business.

More benefits include:

- Simple online application process

- Bad credit accepted

- No credit checks

- Lower eligibility requirements

- No psychical collateral required

- No restrictions on funds usage

For a more detailed breakdown of each benefit read 20 benefits of an MCA

Drawbacks of a Merchant Cash Advance

The biggest drawback of a merchant cash advance is its high fees and short repayment periods lead to increased costs and could strain your business’s cash flow.

More drawbacks include:

- More expensive than loans

- Very high APR rates

- Daily repayments may hurt future cash flow

- Shorter repayment periods

- Won’t improve credit score

- Cash-only businesses are not eligible

For a detailed breakdown of each drawback read 10 drawbacks of an MCA

How much will a merchant cash advance cost?

The total borrowing cost of a merchant cash advance is the advance amount plus the factor rate fee, which ranges from 1.1 to 1.5 (equivalent to 10%-50%). To determine the true cost, multiply the advance amount by the factor rate. For example, an advance of $10,000 at a factor rate of 1.1 results in a total payback of $11,000. At the highest factor rate of 1.5, the payback amount rises to $15,000.

Most MCA companies just charge a flat factor rate fee, but some brokers and online lenders also charge additional fees like origination, processing, and early repayment fees. These extra charges can significantly increase the overall cost of the advance, making it crucial to verify with the MCA funder if they charge additional fees so you know the true cost before agreeing to the terms.

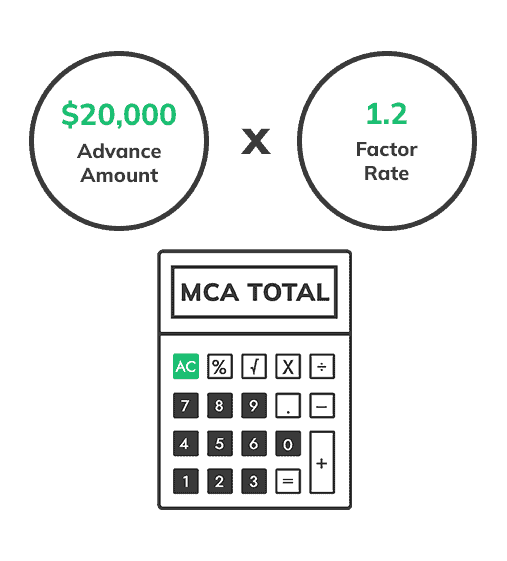

Merchant cash advance example

Imagine your business makes $25,000 each month from credit and debit card sales. You need quick cash for some expenses, so you apply for a $20,000 merchant cash advance.

The MCA provider evaluates your credit card sales and business’s credit risk. They offer the $20,000 at a 1.2 factor rate with a 15% holdback each day.

This means the $20,000 MCA will cost you ($20,000 x 1.2) = $24,000 in total. From your average monthly credit card sales of $25,000, the provider will hold back 15% each day ($25,000 x 0.15 / 30) = $125 per day.

At an average of $125 a day, it’ll take around 192 days, or 6.4 months, to repay the $24,000.

Repayment time varies with your daily sales. More sales mean quicker repayment: fewer sales mean slower. The 15% deduction remains constant.

Use this MCA calculator to get an idea of what an MCA might cost you, based on what you’re looking for.

| Details | MCA Example |

|---|---|

| Advance Amount | $20,000 |

| Factor Rate | 1.2 |

| Holdback | $125 per day (15% of daily credit card sales) |

| Estimated Repayment Period | 6.4 months |

| Total Pay Back | $24,000 |

| Estimated APR | 71.17% |

Why are funding offers sometimes lower than the amount requested?

The amount of cash the MCA provider offers you may be lower then the amount you request. This is because the MCA provider may feel giving you the full amount is too risky. They decide how much to offer based on the strength of your credit card sales, your credit history and business history. Providers usually offer 50% to 250% of your credit sales.

How are merchant cash advances evaluated?

First, our fintech software checks if you pre-qualify for a merchant cash advance. Then, one of the underwriters at MCashAdvance reviews your application and supporting documents. The underwriter starts by checking the strength of your monthly credit card sales.

Next, they review your bank statements to check your business’s cash flow. They look for red flags like too many NSFs, negative overdrafts, or other debts. After that, they do a soft inquiry to view your personal and business credit scores. This won’t affect your credit.

They will use this information to decide to offer you funding. They will also use it to determine how much they will charge (factor rate fee) to provide you with the advance.

For a more detailed breakdown of the evaluation process read MCA underwriting

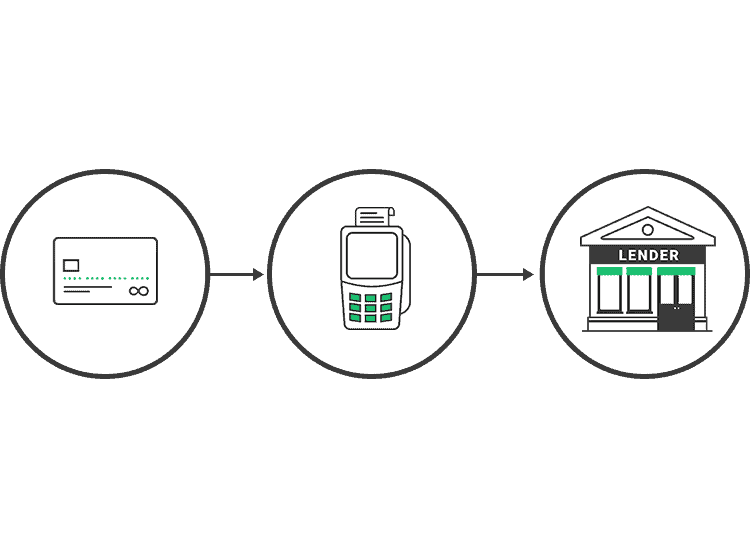

How to repay a merchant cash advance?

There are two main ways to repay an MCA: either the MCA company deducts a percentage of your credit card sales directly from your card processing merchant account, or they withdraw fixed payments from your business bank account.

Percentage of credit card sales deductions: The MCA company works with your credit card processor to deduct a fixed percentage of your daily credit card transactions. This method is called split withholding. The amount you repay varies based your daily card sales volume — more card sales mean faster repayment, while lower card sales mean you pay back less.

Fixed payment bank withdrawals: The MCA company withdraws fixed payment amounts from your business bank account. This amount, typically debited weekly, is based on an average of your monthly credit card receipts. This method is known as ACH withholding. It offers a predictable repayment schedule, which helps in managing cash flow more effectively.

Key things to consider: The repayment continues until you have repaid the advance amount, plus the factor rate fee and any other fees you agreed to. MCA companies try to keep repayment periods between 3 and 18 months.

For a more in-depth breakdown of the repayment process, read our “how to repay an MCA” guide.

The differences between merchant cash advances and business loans

| Loan Features Comparison | Merchant Cash Advances | Bank Loans | SBA Loans |

|---|---|---|---|

| Funding Amounts | $5,000-$900,000 | $100,000 | Credit dependent. |

| Application Process | Short online application process with same day approval and no paperwork. | Long application process with lots of paperwork. | Long application process with lots of paperwork like business plans. |

| Bad Credit Accepted | Yes | No | No |

| Hard Credit Check | No | Yes | Yes |

| Approval Time | In as little as 24 hours. | Takes weeks. | Takes weeks. |

| Time to Funding | Same day funding. | 1-3 Months. | 1-3 Months. |

| Approval Criteria | Credit Card Sales. | Credit score and collateral. | Credit score and collateral. |

| Borrowing Costs | High (15% to 50%) | Low (6% to 12% ) | Low (11% to 15%) |

The table shows the differences between merchant cash advances and traditional business loans. To learn the key differences between MCAS and other business financing options, like business lines of credit, invoice financing, equipment financing read the top 10 alternatives to merchant cash advances.

Is MCA funding right for your business?

MCA funding is a good funding option for businesses with strong credit card sales that may not meet the strict loan criteria to qualify for a loan. But its high rates and fees make it a very expensive alternative type of business funding.

Before you commit to MCA funding or any alternative financing that offers bad credit business loans, make sure it’s a financially sound choice for your business so you don’t end up falling into a cycle of debt.

Frequently asked questions

Get funded the same day you apply for your MCA. Receive your cash in as little as 24 hours. Our average funding time is 1-3 days. To speed up the approval process and funding time, have your last 3 months’ business bank statements ready after applying. Also, ensure you’re available for a call at the provided number if needed.

Bad credit does not prevent you from getting a merchant cash advance because the approval process focuses on the strength of your credit card sales. But because you have bad credit, you can expect to pay a higher factor fee. As long as you have strong credit card sales, and your bad credit is FICO 550 or above you can get an MCA from MCashAdvance.

A merchant cash advance is not considered to be a loan, so it is not reported to the credit bureaus, so your credit won’t get hurt. But, if you can’t pay it back, the MCA provider might involve a collections agency or sue for the amount owed. If a court or collections judgment goes against you, this gets recorded on your credit report and will hurt your credit. Read MCA credit reporting to learn more.

No credit check is conducted when you apply for an MCA. Only a soft credit pull is carried out to ensure your credit won’t be affected.

Because MCAs have high fees and short repayment periods, this can make cash flow problems worse if your business’s cash flow is already very unstable.

If you default on the MCA, the funder can send the debt to a collections agency or file a lawsuit to seize your business assets to recoup their losses. Even if you miss one payment, that is usually considered a breach of contract and you are considered to be in default of your MCA agreement. Read more about the consequences of defaulting on an MCA and how to avoid them.

MCAs are legal because they are structured as purchases of future revenue, not business loans, so they are not subject to usury laws like traditional lenders. Because MCA providers are not subject to federal regulation like traditional lenders, some states have implemented regulations to protect small businesses from predatory practices of a small number of MCA providers.

Yes, an MCA is a type of unsecured financing, so you don’t need to offer assets or collateral to secure the funding. However, some MCA providers may request a personal guarantee. This means if your business fails to repay the advance, you would be personally responsible for the debt.

Is an MCA tax-deductible?

Funds from an MCA are not taxed when received. However, you will need to pay taxes on the revenue you generate that is used to repay the MCA. This is because the MCA is an advance on your future revenue. The rates and fees may also have different tax implications. For a detailed breakdown, read MCA taxation guidelines.

Yes, it is possible to refinance an MCA. You can either approach your current MCA provider for refinancing options or consult a different lender and secure financial instruments, like a term loan, to settle the MCA balance. Read refinancing an MCA to know your options and the key steps to take.

Can startups get an MCA? Yes. Startups can qualify for MCAs provided they meet the minimum qualification. Read MCAs for startups to confirm if your startup qualifies.

Can Multiple MCAs be Consolidated? Yes. Your MCA provider may be willing to roll multiple MCAs into a single new cash advance. You also have to option to approach a lender that offers consolidation loans to pay off your existing MCA debts.

While MCAs become popular during the 2008-09 financial crisis when it was difficult to secure credit from traditional lenders, the origin of MCAs date back to the 1990s. Read the history of the MCA industry to learn more.

It depends. Some MCA providers incorporate clauses in their agreements requiring you to provide a personal guarantee, making you directly responsible should the business fail to repay. It’s essential to review your agreement carefully before committing. Read more about MCA personal guarantees to understand what they are and how they work in more detail.

Ready to apply?

No hidden costs or fees

No paperwork

5 minute application

Bad credit accepted

No obligation to accept

High approval rates